Hello friends,

in this blog we are going to discuss about how to start SIP in SBI mutual fund

online in existing portfolio. If you are a SBI mutual fund customer and you are

investing SBI mutual fund and you want to start another SIP under the same

portfolio and same fund then how can you invest.

If you are

searching for that topic then you can read this article till end. In this

article we are discussing how to invest in the same mutual fund in which you

have been investing for a long time.

How to start SIP in SBI mutual fund under existing

portfolio:

Before going to

invest SBI mutual fund on your existing fund you have to register on SBI mutual

fund online portal and link your mutual fund in online account. If you have

already started SBI mutual fund online then follow the following steps.

STEP 1: Go to SBI mutual fund motile app ‘InvesTap’ and login to your account.

STEP 2: As you login to your account you will see your fund balance, absolute

return, folio number, current value etc. You will also see a three line option

on near the folio number. Click on this three line option.

STEP 3: As you click on the three line another some options details, buy,

switch, redeem, STP, SWP etc. options will be displayed. Click on the option

‘Buy’.

STEP 4: You will be redirected to buying page. In this page you will see your

portfolio, your name, investment details etc. Select the investment details as

SIP, enter investment frequency, installment amount, start date of SIP and end

date of SIP.

Here you will

see an option ‘until cancel’ option. Trick the box before this option. And

thereafter click on ‘Proceed to’.

STEP 5: In this step you need to select your account number. You will find your

account number which you have already added at the time of folio creation.

Select your account number from the drop down menu.

You will see two

mode of investment. One is ‘One time mandate’ and the other is ‘Internet Biller’.

Select ‘Internet Biller here.

Now trick on the

box before ‘I have read the terms and conditions’ term and click on ‘Submit’.

STEP 6: Once your selected details will be appeared on the screen. You have to

check and confirm the page. Hence click on ‘Confirm’.

STEP 7: As you click on the ‘confirm’ button on the above step you will be

redirected to payment status page. In this page you will see a Unique

Registration Number (URN) and your investment fund details. Note down this URN

and you need to add this URN on your Bank’s internet banking biller page.

Now to complete

the start SIP process we will go SBI Yono Lite app add this URN as biller.

Bellow we discussed the steps.

How to add SBI SIP URN number to SBI biller:

You can add the

above URN as biller through SBI internet banking, Yono Lite app and Yono app.

Here we will go through SBI Yono Lite app.

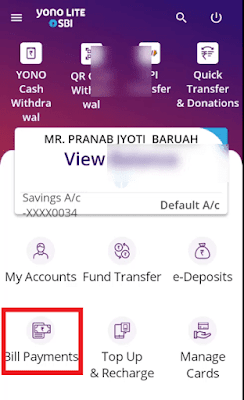

STEP 1: Open SBI Yono lite app and login to your account.

STEP 2: Click on the ‘bill payments’ icon on the dashboard of your account.

STEP 3: A new page will be appeared. Here you will find a list of various

options. Click on the option ‘Add billers’ out of them.

STEP 4: Now select biller location as national, biller category as mutual fund,

biller name as SBI mutual fund, enter a nick name of as you like between 3 to 6

characters, enter the URN number.

Then turn ‘ON’

the auto pay option so that the payment will be done automatically on your

selected date every month.

As you turn on

the auto pay option you are asked to enter auto pay limit. Enter the limit of

auto pay as equal as or greater than your SIP installment.

Now select the

debited account and finally click on ‘Register’.

STEP 5: The selected derails will be appeared once again on the next page.

Check the details and click on ‘confirm’. If anything was wrong then you can

cancel it by clicking on ‘cancel’ button.

STEP 6: An OTP will be sent to your registered mobile number with bank. Enter

the OTP and ‘Submit’. Now the biller added successfully message will be

appeared.

This is the

complete process how to invest in existing portfolio in SBI mutual fund online.

You can watch the all above steps on the following video. Now watch the video.

0 Comments