Hi guys, in this article we are describing about how

to download SBI mutual fund tax statement. If you are a SBI mutual fund

customer and you are using SBIMF mobile app or website then you can easily

download SBIMF tax statement.

SBI mutual fund customers redeemed their folio when

they see gains on it. But if the gained amount is more than exemption limit tax

is deducted on source. On such conditions if you want to get SBI mutual fund

statement for your folio, then how to get SBI mutual fund tax statement.

If you need the statement of SBIMF tax statement

then you can follow this article till end.

How

to download SBI mutual fund tax statement:

If you have open SBI mutual fund from branch or from

net banking and mobile banking then you need to link your folio with SBIMF

online account first. Thereafter you can check tax statement using SBIMF

website or mobile app. Now follow the following steps.

STEP

1:

Go to your mobile and open the ‘Invest Tab’ SBI mutual fund mobile app. Login

to your account using MPIN, finger print or User name and password.

STEP

2:

After login to your account you will see your folio numbers and their current

status. You will see a three line option on the left top corner of the page.

Click on this option.

STEP

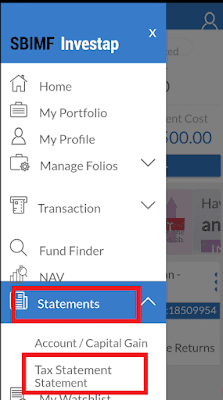

3:

A list of various options will be appeared. Click on the option ‘statement’. As

you click on ‘statement’ option another two another options will be appeared

one is ‘account/ capital gain’ and the other is ‘Tax statement’. Click on the ‘tax

statement’ option.

STEP

4: In

this step you have to select the duration for which you want to download

statement. First of all select the folio number for which you want to get

statement. After that select the duration as for last financial year, last 6

months, current financial year of for custom date range. Select the date range

here and click on ‘submit’.

Now your statement is sent to your registered email

address. You can download your statement from mail received form SBIMF. If any

tax amount is deducted then it will be shown on your statement and it will show

zero if any tax is not deducted. You can also watch the following video on this topic.

.jpg)

0 Comments