Hi, guys in this

blog we are going to discuss about how to pay income tax outstanding demand in

new portal. We all know that income tax India has changed their website. Now

some peoples want to know the process of response to outstanding demand of

income tax in new website.

Hence in this

article we are going to discuss on this topic. If you have been filing ITR in

every financial year and sometimes you show outstanding demand on your filed

ITR. Then how can pay the outstanding demand in income tax online.

Now you can pay

the outstanding demand of income tax online by following some simple steps.

How to pay outstanding demand in income tax in new

portal:

If you want to

know the process of paying outstanding demand, then follow the following steps.

To pay the outstanding demand amount you need to login to your income tax

e-filing account.

STEP 1: Go to www.incometaxindia.gov.in

and open the home page of the website.

STEP 2: In this page you will see a login option on the top right corner of the

web page. Click on the login option to login to your account. As you click on

login you are asked to enter your PAN number.

Enter the PAN

number here and click on ‘continue’.

STEP 3: After click on ‘continue’ you will redirected to a page where you need

to enter your login password and trick on the box before the term ‘please

confirm your secure access massage. Finally click on ‘continue’.

STEP 4: Now you are logged in to your e-filing income tax account. Place the

cursor on the ‘pending actions’ tab. As you place the cursor some more options

will be appeared. Click on the option ‘response to outstanding demand’.

STEP 5: Now you are redirected to the outstanding demand page. In this page you will see the outstanding demand details. Here you will also see the demand amount, response to outstanding demand and pay now option. Click on the pay now option here.

STEP 6: Payment summary will be displayed on the screen. Check the amount and

click on ‘pay now’.

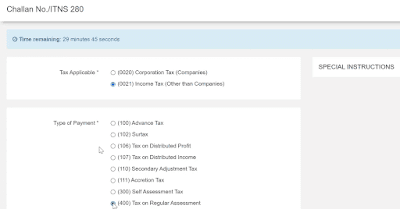

STEP 7: As you click on ‘pay now’ option the e-payment page will be appeared.

Here click on the proceed button under the Challan No./ITNS280.

STEP 8: In this new page you have to enter some details. First of all select the

Tax payable option as ‘(0021) income tax other than companies’ then select the

tax payment as ‘(400) Tax on regular assessment/

Then select the

mode of payment as ‘internet banking’ and select the bank name as State Bank of

India’.

Enter your PAN

number on the permanent account number box. Then select the assessment year

here. After that enter your address, email address and mobile number in this

page enter the captcha code on the box and finally click on ‘proceed’.

STEP 9: In this page you will see the details which you have entered on the

previous step. Trick on the box before the declaration and click on ‘submit to

bank’ button.

STEP 10: You will be redirected to the bank’s site. In this page you need to

select the payment method. You will find two options here Internet Banking and

ATM cum debit card. Select the internet banking and click on ‘submit’ button

here.

STEP 11: Now you will be redirected to SBI Internet banking login page. Enter

your user Id and password and click on ‘login’.

STEP 12: As you click on ‘login’ you will see the details of payment here. Enter

the Tax amount and interest amount here ‘Confirm’. In this page also see the

details once again. Finally click on ‘confirm’.

STEP 13: An OTP will be send to your registered mobile number. Enter the OTP

here.

This is process

how you can how you can. You can also watch the following video to know the above process.

2 Comments

I generally check this kind of article and I found your article which is related to my interest. Genuinely it is good and instructive information. Thankful to you for sharing an article like this.Income Tax Filing in Chennai

ReplyDeleteYou have given great content here. I am glad to discover this post as I found lots of valuable data in your article. Thanks for sharing an article like this.Casual Bookkeeper Melbourne

ReplyDelete