Hi friends, in this blog we discuss

about “how to e-verify ITR through SBI internet banking”. People while file an

income tax return they need to verify their income tax return online or

offline. Without verify your return the process of ITR filing will not be

completed. You can verify the return online by two ways the first one is

through Aadhaar OTP and the other is through internet banking.

If you want don’t go through online

verification then you have to take print out of form - V and need to send it to

CPC Bengaluru. But it takes many times to verify the return. Hence the best

option of verify income tax return is online.

If anyone wish to e-verify income tax

return through Aadhaar OTP then he will receive OTP on mobile. Many times people

do not have the registered mobile number with Aadhaar on their hand. In that

condition they will not receive the Aadhaar OTP which is sent to verify ITR

online. Then they can’t e-verify their return online. Here they can go for the

second option. They can e-verify ITR through internet banking.

If you are using internet banking of

any bank then you can easily e-verify ITR. So we discuss here the steps to

e-verify ITR through SBI net Banking.

How

to e-verify ITR through SBI internet banking: To do e-verification of ITR

through SBI net banking you need to registered with SBI net banking first. To

know how to e-verify ITR through SBI net banking follow the following steps.

STEP

1: Go to SBI internet banking page and login with your user ID and

password. After login to your account you will find an option ‘e-TAX’. Click on

this option.

STEP

2: After click on ‘e-tax’ another page will open where some new options

will be displayed. Click on the option “login to e-filing/e-verify” here.

STEP 3: In this step you are redirected to a page where you will find your savings bank account number. You have to select your account number here. Now click on the “submit” button.

STEP

4: An OTP will be sent to your registered mobile number with SBI. Enter the

OTP on this page and click on ‘confirm’.

STEP

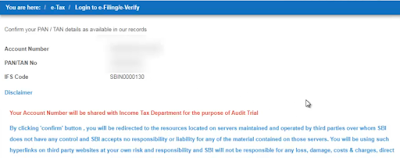

5: Now you will reach to another page. Here you will see your account

number, PAN number and IFSC code of your branch. You will also see the some

instructions on this page. Read all the instructions carefully and click on

“confirm”.

STEP

6: Here you are redirected to income tax India’s account. A pop up massage

will displayed saying that you have not update your contact details, please

update them. Click on the option continue. Then the pop up window will go away.

You will see an option “Skip” on the bottom of the page, click on this option.

STEP

7: In this step again another pop up massage will displayed it ask you whether

you want to add this account number pre-validate account list. If you wish to

add the account number then click on “confirm” otherwise click on “cancel”.

STEP

8: Now you will see the dash board of your income tax account. Here you

find tow options in red colour. Click on the option “view return forms”.

STEP

9: Here your PAN number will displayed. You have to select ‘income tax

return’ from the drop down menu and click on ‘submit’.

STEP

10: In this page you will see the list of ITR of previous years and current

year. You will also see an option “click here to view returns pending for

e-verification”. Click on this option.

STEP

11: A new page will open. You will find the returns pending for “e-verification”.

An option “e-verify” against the return will be seen. Click on this option. A pop up massage will

open. It displayed you an acknowledgement number. It says that if you click on

the ‘continue’ option then an EVC will generate automatically and applied to

the return. You need not send ITR V form to CPC Bengaluru. Click on the ‘Continue’ option.

STEP

12: In this page an massage will be displayed saying that “Return

successfully e-verified”.

If you want to see the above steps

through video then watch the following video.

0 Comments